Errors associated with educational credits, specifically for Form 1098-T, can be easily misinterpreted.

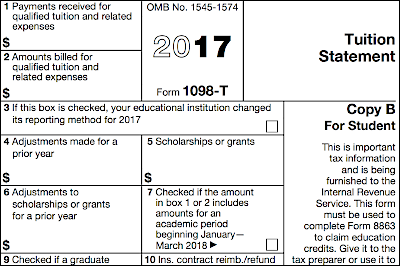

Eligible educational institutions often file Form 1098-T to report either the aggregate amount of payments received (Box 1) for qualified tuition and related expenses or the aggregate amount billed (Box 2) for such tuition and expenses. Should you receive this form, here are four common errors to watch for, and how to interpret them.

- Educational credits are based on the amount of adjusted qualified education expenses paid for the student in 2016 for academic periods beginning in 2016 or beginning in the first 3 months of 2017. An issue occurs when the costs for early 2016 tuition were billed in 2015, and the educational institution utilizes Box 2 of Form 1098-T.Example: In January 2016, Alex pays $6,000 for his final semester of classes. The university Alex attends actually billed the tuition payment in December 2015. In May 2016, Alex pays certain qualifying expenses amounting to $200. Alex receives Form 1098-T for 2016. Box 1 is blank, and box 2 includes $200.

How much does Alex include on Form 8863 as qualifying higher education payments for 2016?

Alex utilizes the amounts actually paid in 2016, $6,200, even though the Form 1098-T reports only $200. - Effective for 2016 Form 1098-T filings, PATH eliminated the above issue by removing the option to report aggregate expenses billed for the calendar year. However implementation was delayed for one year.

- Form 1098-T reports the student’s ID number, yet if the student is claimed as a dependent on a parent’s tax return, the parent is entitled to the credit. Many parents self-preparing their own returns miss this credit as the 1098-T does not include their ID number.

- New for 2016, paid preparers must include Form 8867 – Due Diligence Checklist for any return which includes the American Opportunity Tax Credit. Completing the form is not a substitute for actually performing the necessary due diligence and completing all required forms and schedules when preparing the return.

As you navigate this year’s busy season, be sure to stay up-to-date on the latest tips and tricks for tax preparers and their clients by subscribing to Tangible Gains: the Surgent blog.

Dennis P. Benvie MS, CPA is Director, Tax and Advisory Content, for Surgent Professional Education. He has been in practice for more than 30 years and has been a national CPE Discussion Leader for 25 years.