Category Archives: Tax

(Video) Tax Professionals Are the Target of This Phishing Scam – Don’t Become a Victim

By Surgent CPE

We talked to Craig W. Smalley, EA, Founder & CEO of CWSEAPA, PLLC, a multi-state tax firm, about a phishing scam that’s targeting tax professionals. CPAs, EAs, and tax preparers: find out how not to become a victim.

The IRS announced the latest “Dirty Dozen” scams. As this year’s tax season nears the finish line, keep in mind that taxpayers are subject to these scams year-round.

Intellectual Curiosity: It’s Admirable, but is it Deductible? Where to Draw the Line for Business Expenses

By Surgent CPE

Can individuals deduct for business expenses associated with education outside of work? Read more for where the Tax Court drew the line in this case.

Take a quick break from busy season and hear stand-up comedian Greg Kyte, CPA share his latest joke.

With just about half of this year’s busy season in the rearview mirror, it’s time to pause and reflect. How has this busy season differed from other years? Take the CPA Trendlines Busy Season survey and tell us.

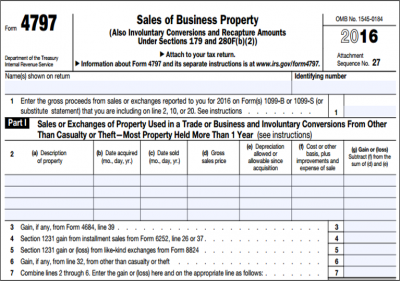

Form 4797 generally reports the sale of assets utilized in a trade or business as described in IRC §1231, but it can be tricky to complete without errors. We’ve broken down Form 4797 into what’s good, what’s difficult, and what can be an all-around headache.

Though many of the details remain unclear, there’s a general consensus that tax reform is on its way. Forbes’ tax policy blogger, Tony Nitti, CPA, talks about why CPAs need to be prepared for any possible outcome, and why the time to start preparing is now.

What’s the buzz about the Border Adjustment Tax, and why should you pay attention to it?

On January 17, the IRS published draft Form 7004 Instructions, extending the due date for C corporation returns to October 15, 2017.

Lien Foreclosure & Subsequent Sale of Property Owned by Innocent Party OK’d in District Court: What this Means for Property Co-Owners

By Surgent CPE

Lien Foreclosure & Subsequent Sale of Property Owned by Innocent Party was recently OK’d in District Court. Surgent’s Director of Tax & Advisory Content shares his thoughts on why tax delinquency issues should be explored among co-owners prior to purchase and titling.