Category Archives: Tips & Resources

With the amount of tax updates coming down the pipeline this year, Forbes tax policy blogger Tony Nitti, CPA, shares on this video why 2017 is not the year to put off completing your Federal Tax Update CPE requirement.

ASU No. 2016-02, Leases (Topic 842), the new lease accounting standard, is here. In this post, we highlight 10 items for consideration as you plan to adopt this standard.

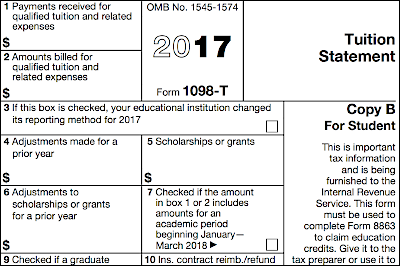

Eligible educational institutions often file Form 1098-T. Should you receive this form, here are four common errors to watch for, and how to interpret them.

Too often, middle income clients fail to seek the advice of a CPA because they’ve been taken in by two common myths. We know these are myths because every year, our estate planning discussion leaders present courses packed with practical tips and creative strategies that can be used for and with middle income clients. We’ve picked five of those tips to share with you.

With the effective date of both SSAE No. 18 and SSARS No. 23 just around the corner, now is the time to get up to speed on attestation engagements and the changes brought about by these new standards.

Charlie Blanton, CPA, expert in fraud and abuse in not-for-profit entities and governments, offers his advice for not-for-profits when it comes to fraud protection.

No business owner wants to be faced with an IRS audit, and some may never have to, but if you receive a tax audit notice, be prepared with these 5 tips.

With ASU No. 2016-20, Technical Corrections and Improvements to Topic 606, Revenue From Contracts With Customers, the FASB continued its response to implementation challenges and requests for clarifications received from the Transition Resource Group (TRG). The TRG, the group of practitioners, accountants and financial statement preparers tasked with vetting questions concerning Topic 606, Revenue from […]

A Year in Review: The Biggest 2016 Tax Developments to Take With You, and What to Watch for 2017

By Surgent CPE

As we close out 2016 at Surgent Professional Education, we’ve rounded up some of the most impactful tax developments of 2016 – a monumental election year that delivered a push-and-pull of amendments, policy developments, and news bulletins. Keeping in mind the looming possibility of tax reform in 2017, we’ve also highlighted the areas we’re watching […]

The reality is that accountants are a pretty cool bunch who have, over the years, contributed a whole lot more to society than just the double-entry bookkeeping system.