Tag Archives: ACA

The Senate released its long-anticipated Obamacare replacement bill on June 22, 2017. Senate GOP leaders are intent on voting on it before the July 4th recess, pegging June 29th as the likely day for the vote. Read more for how this bill will affect the net investment income tax, Medicaid, and more.

ACA Form 1095 Reporting Requirements in 2017: The Good, The Bad, and the Merely Confusing

By Surgent CPE

Though we’re on the brink of some sort of changes to the ACA, current guidance around healthcare reporting still stands. Here’s a quick rundown of what were we still need to comply for form 1095 and taxpayer self-reporting.

Late Monday, March 6, the full text of Congressional Republicans’ proposal to repeal and replace the Affordable Care Act was finally released. The bill, which has been given the title “The American Healthcare Act,” is now with the Congressional Budget Office (CBO) for “scoring” to determine its costs and impacts. Here’s what we know now about key provisions and their timing.

A Year in Review: The Biggest 2016 Tax Developments to Take With You, and What to Watch for 2017

By Surgent CPE

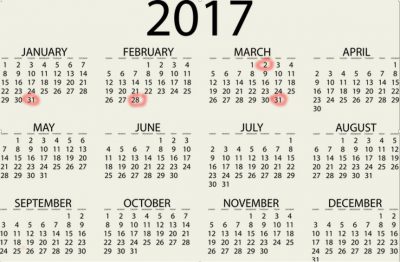

As we close out 2016 at Surgent Professional Education, we’ve rounded up some of the most impactful tax developments of 2016 – a monumental election year that delivered a push-and-pull of amendments, policy developments, and news bulletins. Keeping in mind the looming possibility of tax reform in 2017, we’ve also highlighted the areas we’re watching […]

In a surprising move, the Internal Revenue Service (IRS) issued Notice 2016-70 this week, extending the deadline for employers to furnish form 1095-C to employees and extending the good faith transition relief to the 2016 reporting year.