Tag Archives: form 1040

Intellectual Curiosity: It’s Admirable, but is it Deductible? Where to Draw the Line for Business Expenses

By Surgent CPE

Can individuals deduct for business expenses associated with education outside of work? Read more for where the Tax Court drew the line in this case.

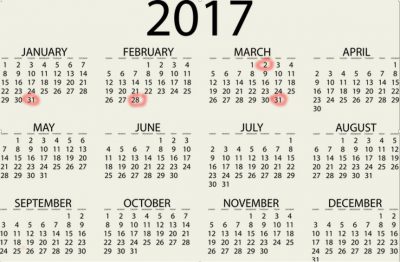

ACA Form 1095 Reporting Requirements in 2017: The Good, The Bad, and the Merely Confusing

By Surgent CPE

Though we’re on the brink of some sort of changes to the ACA, current guidance around healthcare reporting still stands. Here’s a quick rundown of what were we still need to comply for form 1095 and taxpayer self-reporting.